Introduction: The Evolving Landscape of Global Supply Chains

The global supply chain has undergone a seismic shift since 2020, reshaped by the COVID-19 pandemic, geopolitical tensions, technological advancements, and growing sustainability concerns. This article examines the current state of global supply chains, the challenges they face, and the economic implications of these transformations.

Post-Pandemic Recovery and Persistent Volatility

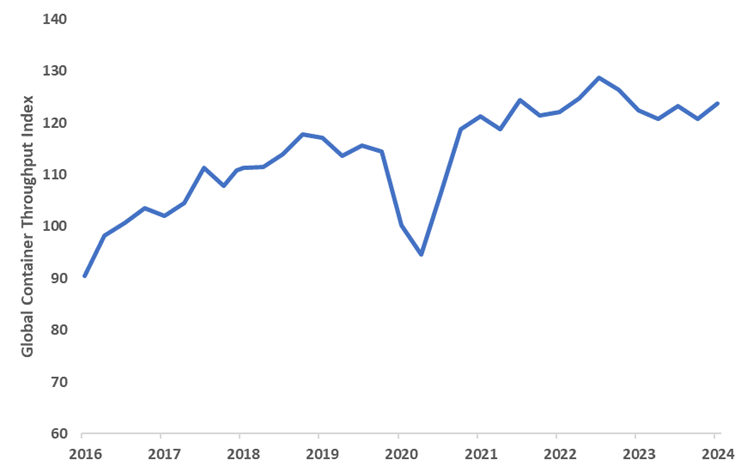

The global supply chain has shown remarkable resilience in recovering from the initial pandemic shock. The global container throughput index, which measures the volume of containers handled at ports worldwide and serves as a key indicator of global trade activity, reached 123.8 in January 2024, up from 110.5 in January 2021. This recovery, however, has been accompanied by persistent volatility.

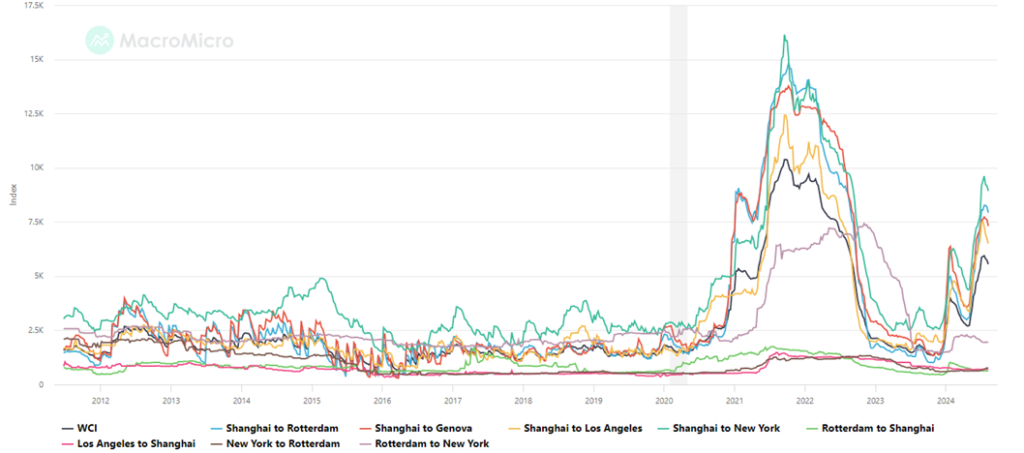

One of the most visible signs of this volatility has been the fluctuation in shipping costs. Average global shipping container prices peaked at $10,800 in September 2021 before declining to $2,800 in Q1 2024. While this represents a significant decrease, prices remain above pre-pandemic levels, continuing to impact global trade dynamics.

The semiconductor industry serves as a prime example of ongoing supply chain challenges. Despite increased production capacity, periodic shortages continue to affect various sectors, from automotive to consumer electronics. This situation highlights the complex interdependencies in modern supply chains and the lasting impact of major disruptions.

Geopolitical Tensions and the Reshaping of Trade Patterns

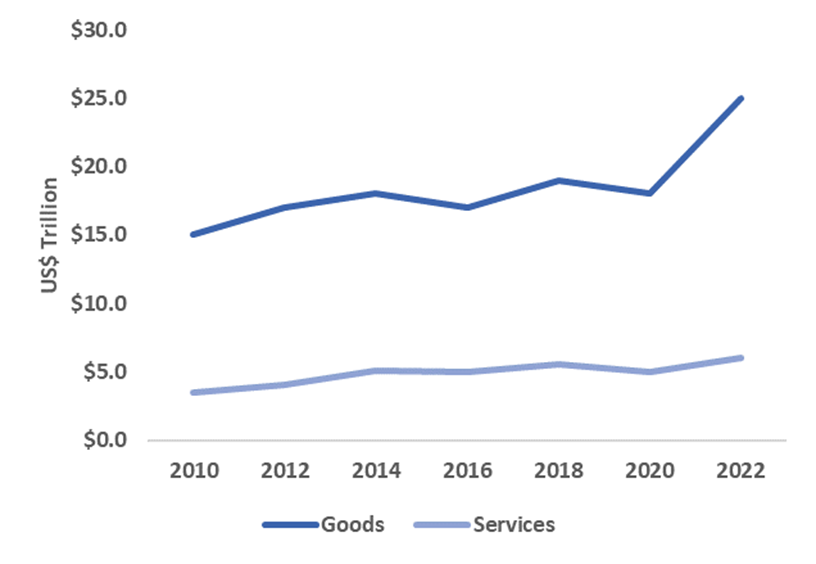

Escalating geopolitical tensions, particularly between major economic powers, have prompted a reevaluation of global trade dependencies. The concept of “friend-shoring” – relocating supply chains to countries considered allies or friendly nations – has gained traction. This shift is reflected in trade statistics, with the value of global trade reaching a high of $32 trillion in 2022 from $27 trillion in 2021, declining to $31 trillion in 2023, and projected to hit $32 trillion in 2024.

However, this growth has not been evenly distributed across regions. A 2023 McKinsey survey revealed that 62% of U.S. companies were planning to regionalize their supply chains. This trend toward regionalization reflects a strategic shift as businesses seek to reduce risks associated with global supply chain disruptions and geopolitical tensions. While this shift is expected to create more resilient supply networks by concentrating operations closer to key markets, it could also lead to less efficient production processes due to reduced economies of scale and increased costs. The move towards regionalization is reshaping global trade patterns, with some regions benefiting from increased investment and trade flows (Vietnam), while others may experience a decline in their traditional roles as global manufacturing hubs (China).

Technological Integration and Digital Transformation

The integration of advanced technologies has become crucial for supply chain resilience and efficiency. The global supply chain management market size reached $28.9 billion in 2022 and is expected to grow to $45.2 billion by 2027, representing a compound annual growth rate (CAGR) of 9.4%.

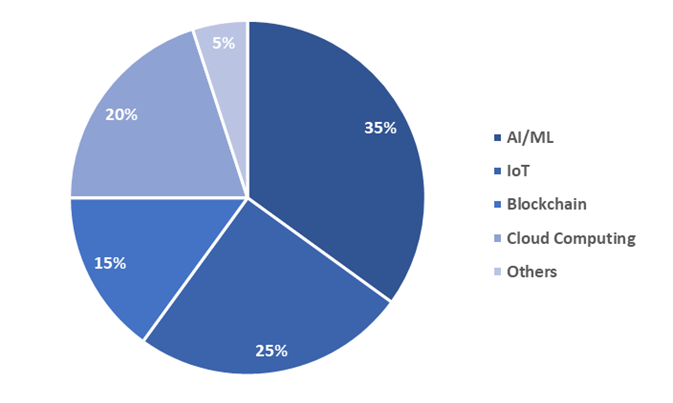

Artificial Intelligence (AI) and Machine Learning (ML) dominate new technology investments, accounting for 35% of the total new investments made to enhance supply chain management. This underscores the growing reliance on AI/ML for applications such as demand forecasting, inventory management, and route optimization, with 79% of companies investing in AI for supply chain management in 2023.

The Internet of Things (IoT) and blockchain technologies are also key components of this integration, enhancing transparency, connectivity, and traceability across the supply chain. Cloud Computing continues to play an essential role in enabling scalable and flexible operations, while other emerging technologies contribute to a diverse and evolving landscape. Digital twins—virtual replicas of physical supply chains—are gaining prominence within these technological domains, allowing companies to simulate scenarios and optimize operations in real time, further driving the efficiency and resilience of global supply chains.

Climate Change and Sustainability Imperatives

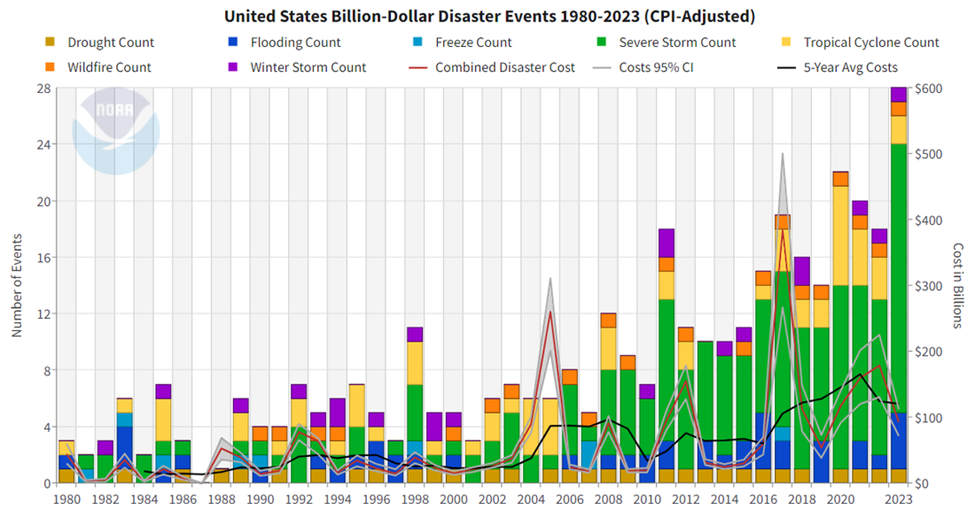

Climate change continues to pose significant challenges to global supply chains. The frequency of weather-related disruptions has increased dramatically, with 28 weather disasters causing over $1 billion in damage in 2023, up from an average of 7.7 per year in the 1980s.

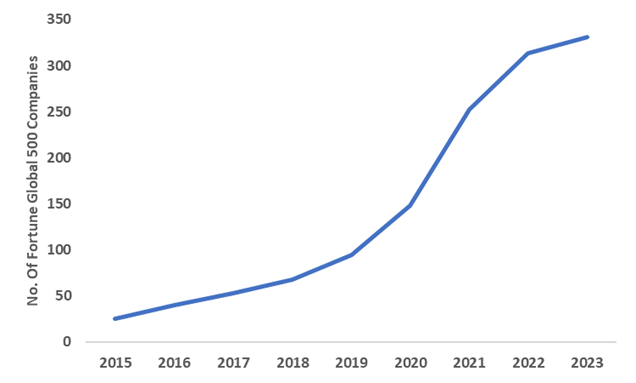

In response, companies are increasingly prioritizing sustainability in their supply chain operations. As of 2023, over 70% of Global 500 companies had adopted science-based emissions reduction targets, up from 30% in 2020. This shift is spurring innovation in materials, processes, and logistics strategies, with potential long-term benefits for both business resilience and environmental impact.

Labor Market Dynamics and Automation

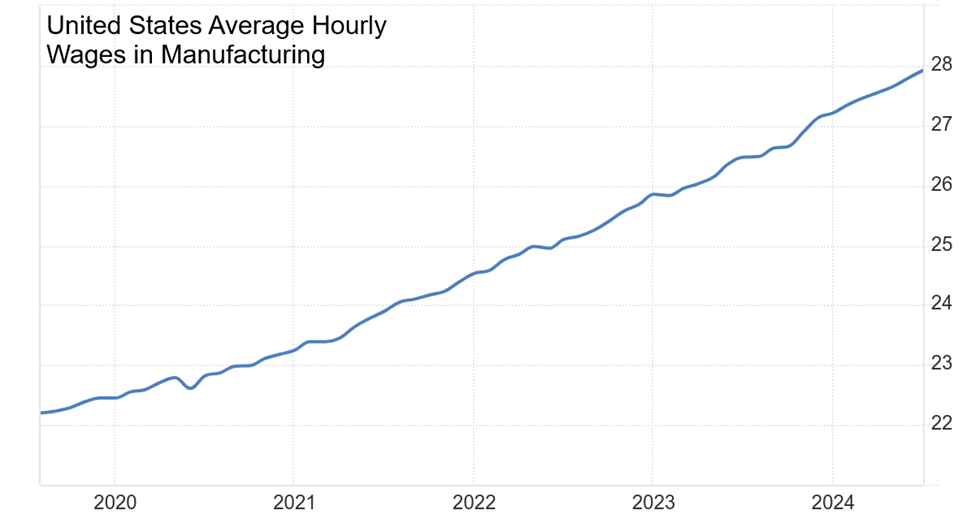

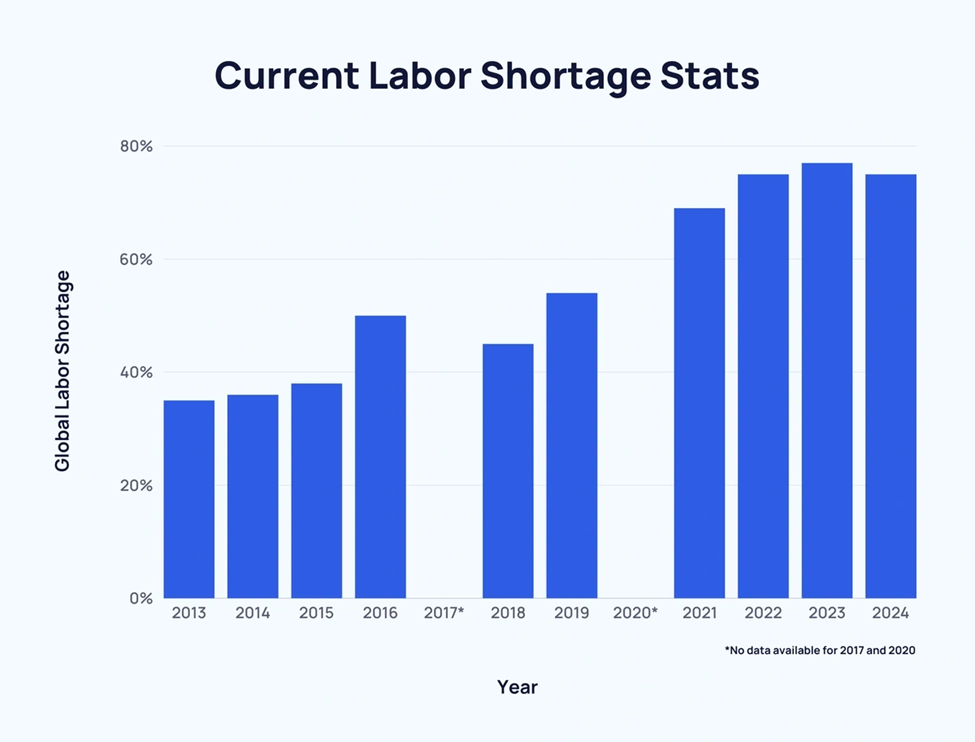

The global logistics sector faces significant labor challenges, with a projected shortage of 2.1 million workers by 2030. This shortage is driving wage increases, with the average US manufacturing worker’s hourly wage reaching $28 in 2024, a 27% increase from 2019.

According to ManpowerGroup, 75% of employers are currently facing significant challenges in filling labor vacancies, marking the second-highest level of reported shortages since surveys began in 2006. This reflects a dramatic increase compared to earlier years, with the proportion of employers reporting labor shortages nearly doubling since 2015, when the figure was at 38%.

The persistent and growing labor shortage is driving wage increases and accelerating automation in warehouses and distribution centers. While automation may alleviate some labor shortage issues, it also raises questions about the future of work in the logistics sector and the need for upskilling and reskilling programs.

Reshoring and Nearshoring Trends

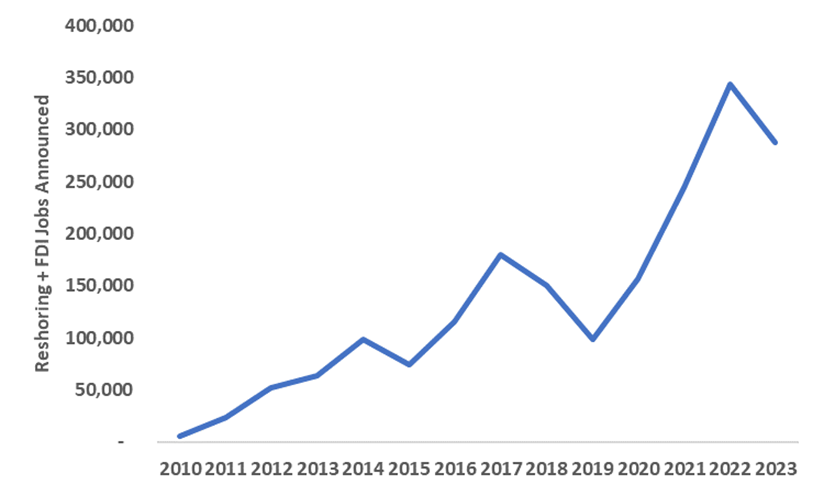

The push for supply chain resilience has accelerated reshoring and nearshoring initiatives. In the US alone, there were 288,000 reshoring and foreign direct investment (FDI) job announcements in 2023, an 80% increase from 2020. Moreover, 92% of North American manufacturing executives were considering reshoring in 2023, up from 78% in 2021.

The dramatic increase in reshoring and FDI indicates a significant shift in supply chain strategies, prioritizing resilience and proximity to markets over pure cost efficiency. This trend towards localized production is reshaping global manufacturing landscapes. While it can potentially reduce transportation costs and lead times, it also requires significant investments in new facilities and workforce development.

Economic Implications

The ongoing evolution of the global supply chain has far-reaching economic consequences:

- Inflation Pressures: Supply chain disruptions have contributed an estimated 1.5 percentage points to inflation in advanced economies in 2023. The global inflation rate stood at 6.8% in 2023 and is projected to be 5.8% in 2024.

- Investment in Resilience: Global supply chain resilience investment reached $33 billion in 2023 and is projected to grow to $45 billion by 2025. While these investments may increase costs in the short term, they aim to reduce volatility and disruptions in the long run.

- Shift in Global Trade Patterns: The reconfiguration of supply chains is altering global trade flows, with potential long-term impacts on economic development patterns worldwide.

- Technological Advancement: The drive for digital transformation is spurring significant investments in technology, potentially boosting productivity in the long term.

- Labor Market Shifts: As supply chains evolve, there’s a growing demand for skills in areas like data analytics, robotics, and sustainable supply chain management.

Conclusion

The global supply chain landscape of 2024 is characterized by a delicate balance between efficiency, resilience, and sustainability. Companies are addressing complex challenges through technological innovation, strategic regionalization, and a renewed focus on risk management. As the situation continues to evolve, adaptability will be key. The era of just-in-time efficiency has given way to an age where resilience, sustainability, and agility are the new cornerstones of successful supply chain management. Those who can effectively manage this new landscape will be best positioned to thrive in the evolving global economy.

Subscribe to our Newsletter to get exciting content delivered to your Mailbox!