Introduction

MTAR Technologies started as a partnership firm in 1970 and was incorporated as a private limited company in 1999 by Late P. Ravindra Reddy, Sri K. Satyanarayana Reddy, and Sri P. Jayaprakash Reddy. The company has eight manufacturing units in Hyderabad and falls under the Precision engineering industry. Precision engineering is a sub-discipline of engineering and is concerned with manufacturing and assembling items that have an exceptionally low tolerance and are required to perform consistently over longer repeat cycles. Precision engineering products have tolerance in the range of less than 10 microns. That means the component has to be very accurate. The machines which are manufacturing these components have to be very efficient and sophisticated.

Precision engineering products important for critical applications such as aviation, aerospace, space, defense, and nuclear power plants, control equipment for process plants, where errors can cause greater damage to livelihood and to the environment.

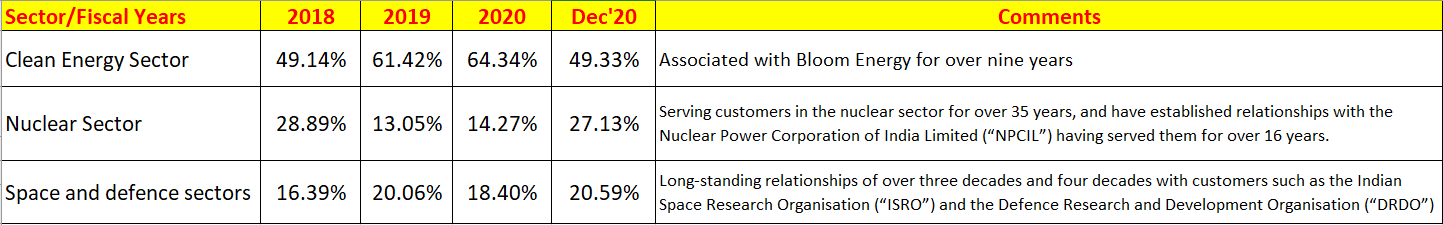

- Customers — They primarily serve customers in the clean energy, nuclear and space, and defense sectors.

- Products — MTAR’s major product portfolio includes 14 kinds of products in the nuclear sector, six kinds of products in space and defense sectors, and three kinds of products in the clean energy sector.MTAR Technologies Ltd will be the first manufacturer of precision engineering roller screws in India for nuclear, defense and space segments. MTAR is also planning to set up a specialized sheet metal fabrication facility, in 2021, for the defense, aerospace, and fuel cell sectors.

- Competitors– There are many players in the precision engineering sector, but these companies are the nearest competitors to MTAR technologies. MTAR is one of the key suppliers to Bloom Energy, which is the largest player in the fuel energy space as per 2019 revenues.

- Management Team— The management team is very experienced and has a diversified background.

- The current shareholders of the company are as follow-

Industry Analysis

Precision engineering has created a niche area in the engineering area. It has very selective end-users like automotive, industrial, and niche applications (defense, nuclear, aviation, and marine).

Auto-components have the highest share in the precision engineering market, followed by defense and aerospace.

In the last five years, the industry has grown at a CAGR of 7.1% and expected to grow at a CAGR of 7% in the next five years. There are different driving factors for each segment.

Growth drivers for Auto-Components, Defense and Aerospace:-

- Indian companies have a competitive advantage vis-à-vis peers in developing and developed economies, in terms of manufacturing and labor costs, market knowledge, technology, and large demand potential. The Government of India has also taken many initiatives to raise the contribution of manufacturing to 25% of GDP by 2025 from the current 17–18%. The growth in the industry will be driven by growth in auto-components domestic as well as export demand, and indigenous manufacturing in the defense segment.

- The government’s focus on strategic sectors such as defense and aerospace will also bolster the demand for precision engineering. In addition, the Government of India has recently announced an import ban on 101 defense-based items which will allow a widespread manufacturing base. Only companies incorporated in India shall be eligible for bidding.

- This industry has high entry barriers as this segment requires high accuracy in machining, positional and dimensions, technology investments in plant and machinery, and past experience plays a very critical role.

- In May 2020, the government increased FDI in defense manufacturing under the automatic route from 49% to 74%. Based on approval basis in the case of modern technology transfer, the government allowed 100% FDI in defense in 2014.

- With the government’s thrust on Make in India, defense public sector companies, such as Hindustan Aeronautics Ltd (HAL) and Bharat Dynamics Ltd, have been taking initiatives to increase domestic sourcing across components. Also, some of the foreign companies like Boeing and Lockheed Martin have shown interest in manufacturing aircraft in India.

Growth drivers for the nuclear equipment industry:-

- Currently, India has 22 operational reactors and an additional seven are under construction. The share of nuclear power in India’s total generation is 2.9%. This is significantly less compared with more advanced nations such as France, the US, and China where the share of nuclear energy is 70.6%, 19.4%, and 4.6%, respectively.

- With international cooperation, the nuclear energy outlook has improved and the Indian government is working towards its investments to achieve its nuclear power generation target. Traditionally, India has been meeting its energy requirements by importing fossil fuels. Reducing the dependence on these imports is one of the major driving forces behind investment in nuclear power.

India doesn’t allow private participation in the nuclear power programme. Hence, state-run Nuclear Power Corporation of India (NPCIL) controls all the operational. NPCIL has developed an ecosystem of suppliers that are stringently evaluated for quality and reliability. This has led to industry consolidation with only a few major players supplying critical components to NPCIL. This key players comprise of L&T, Godrej & Boyce, MTAR Technologies.

- One of the major growth drivers for India’s nuclear program is the consistently increasing demand for electricity. In the long term, power demand is expected to be supported by economic growth recovery, expansion in reach via the strengthening of transmission and distribution (T&D) infrastructure, and improved power quality, thereby registering a 3–4% CAGR over the next 5 years.

Growth drivers for fuel cell (Clean Energy) industry-

- With growing concerns over climate change, the government is pushing companies to produce electricity via clean energy. The government is providing funding and incentives to the companies that are into this process. For example in the USA, Tesla gets regulatory credit for producing electric vehicles as it is saving the environment from the pollution caused by diesel/petrol-based vehicles.

- Fuel cell technology is one of the evolving distributed sources of electricity. Fuel cell utilizes hydrogen for the production of electricity. Hydrogen can help to curb carbon emissions globally and, while support for hydrogen is steadily increasing within the US, many other nations are also taking an active approach by implementing hydrogen-focussed strategies and investments.

- Major factors driving the fuel cell market include growing demand to decarbonize energy end-use, government regulations for desulphurization of refinery activities, and increased demand for hydrogen in the transportation sector. Fuel cell technology provides an alternative source of clean energy with zero-emission and high efficiency. Fuel cell technology provided a promising alternative for a continuous source of energy, unlike other renewable energy sources.

- Bloom Energy has signed an MoU with a central public sector undertaking, to deploy fuel cell technology in India by using natural gas as fuel (Bloom Energy, which is one of the major players in the solid oxide fuel cell space, has installed the majority of the solid oxide fuel cell space installation in the US and is now targeting the South Korean and the Indian market)

Growth drivers for the space sector

- The global space market opportunity amounts to USD 360 billion. Increased use of space launch vehicles for satellites and testing probe applications, the introduction of space tourism, and the development of satellite internet systems have propelled the growth globally. In addition, ISRO intends to commercialize the Indian space sector and offer its products and services to other countries.

- Further, ISRO has also announced the manufacture of a small satellite launch vehicle (“SSLV”) that shall be able to lift satellites up to 500 kilograms in the lower Earth orbit thereby making the space launches of ISRO, even more, competitive for lower payloads.

- ISRO is also working on certain major missions such as Gaganyaan, Aditya-1, and Shukrayaan-1, among others These activities are expected to provide exponential growth to the Indian players operating in the space sector and MTAR technologies is expecting that it will help their order book to grow significantly in the future.

Risk —

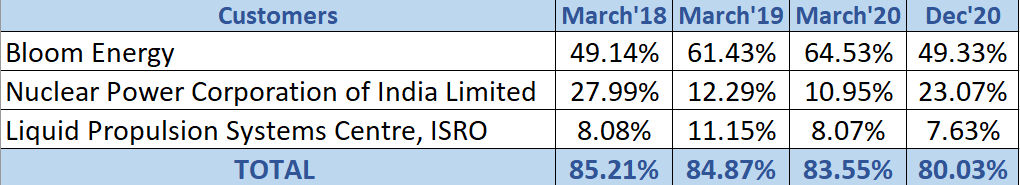

- Revenue Concentration — Significant portion of their revenue comes from few customers like Bloom Energy Inc, the Nuclear Power Corporation of India Limited (“NPCIL”), the Indian Space Research Organisation (“ISRO”), and the Defence Research and Development Organisation (DRDO). If they lose their top customers or there is less demand from them, it will significantly affect their margins. MTAR doesn’t have a long-term purchase agreement with any of its top customers.

As of December 31, 2020, the company catered to 39 customers. Of these, the contribution of the top three customers as a percentage of revenue from operations of the company during the Fiscals 2018, 2019, and 2020, and in the nine months ended December 31, 2020, is as follows:

- Volatility in raw material prices — The raw material consumed is 41.34%, 35.68%, 40.82%, and 42.20%, of the revenue from operations for the fiscal year ended 2018, 2019, 2020, and for the nine months ended December 31, 2020.

Also, if we take a look into their major raw materials, they are mostly commodities. The price of commodities is well known to be volatile, with dramatic upswings and downswings. In near future, one can expect the raw material cost to go up due to two reasons-

Covid-19 forced many companies to shut-down their production for the short-run and disrupted the supply chain, which affected the raw material procurement cycle and inflated the prices upward.

There is a surge of interest in green-energy projects. Around the globe, the government is pushing the development of eco-friendly projects, which further increased the demand for commodities. (Given the supply stays constant and demand increases, prices will also increase).

- MTAR is subject to strict quality standards. Any failure to comply with such quality standards may lead to the cancellation of existing and future orders which may adversely affect its reputation, financial conditions, cash flows, and results of operations.

- Change in government policy — To date, there is no to less competition to MTAR Technologies, but if the government allows foreign investments, then their margin will be affected. Also, if the government allocates less funding towards the respective departments of the Government of India under which these customers operate, or delays in the budget process could adversely affect our ability to grow or maintain our sales, earnings, and cash flow.

Strengths

- Precision engineering expertise with complex product manufacturing capability. The company has an established presence in the engineering industry, catering to varied segments, including power, nuclear, space, aerospace, and defense. The company is the sole supplier of several products to its clients, indicating its expertise in the manufacturing niche and quality products, which also limits competition. MTAR owns a large range of sophisticated and modern equipment.

- The company has also invested in the development of roller screws, which is an import substitute. Once this development has been completed, MTAR Technologies will be the first manufacturer of roller screws in India. This product shall be used for a wide variety of applications in the nuclear, space, and defense sectors. We can expect this product to grow as the government is pushing corporate bodies to be more atmanirbhar.

- Their suppliers are not only based in India but also in the USA and Brazil. This enables the company to negotiate favorable terms and even avail of better discounts. It also helps them in minimizing supplier risk on account of low supplier dependency.

- The company is primarily led by Parvat Srinivas Reddy who has over 29 years of work experience. The current average employee tenure with our Company is approximately 15 years, with a low attrition rate of about 6% in the last three years, which further demonstrates the level of engagement of our workforce.

Financials

- The CAGR growth of revenue from operation from FY18 to FY20 is 14.78%.

- The majority of their revenue comes from the clean energy sector, but in the last few years, their revenue flow is increasing from other sectors as well.

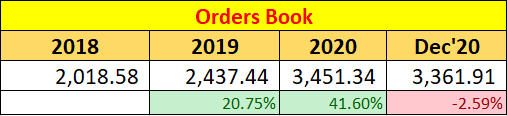

- Order growth is negative in Dec’20 due to the business impacted by COVID-19. Otherwise, it provides healthy revenue visibility in the near-term.

- The majority of their income comes from exports.

- As of December 31, 2020, we had total indebtedness of ₹ 1,488.63 million.

- The cash flow statement also looks strong. The company has negative cash flow from the investing activities as they are expanding their business. The company is in the process of establishing an additional manufacturing facility at Adibatla in Hyderabad which shall be a sheet metal facility and will help them to undertake sheet metal jobs for Bloom Energy, ISRO, and certain other customers. In Fiscals 2018, 2019, and 2020, and in the nine months ended December 31, 2020, the company’s capital expenditure towards additions to property, plant, and equipment, and intangible assets was Rs. 80.01 million, Rs. 227.30 million, Rs. 49.60 million, and Rs. 101.25 million,

respectively.

My views on this IPO-

- Financials — The financials of the company looks good. On average the company’s return on net worth is around 14%, which is pretty decent. Also, they have enough cash to manage their day-to-day operations.

- Management — Strong management with diversified background experience.

- Competition — As of now, there is no direct competition from other players in the sector. But in the future, we can expect competition from big players like L&T and Godrej.

- At the current offering price, the stock looks a little expensive.

- Government support – The government’s focus on being AtmaNirbhar, exports of defense equipment, and rising budgetary allocations (the new defense budget totals $49.6 billion, an increase of more than 3 percent from the previous year’s $47.98 billion) along with entry barriers in the business should support the company in the longer-term.

An investor can apply to this IPO and should actively monitor it. Any change in the board of directors, the emergence of new competition, or change in government policy can fundamentally affect the company’s cash flow.

Excellent Analysis, Juhi!

Thank you Samkit.

Very detailed analysis. Keep it up

Thanks, Priyam.

Good one

Thank you, Sushil.