The past one/one and half year have been quite a roller coaster, with markets falling 34-35% and recovering more than 90%, reaching all-time highs. The move from extreme pessimism to extreme optimism has been quite exciting for many of the novices. Unrealistic expectations of making quick bucks have exacerbated the irrational behavior of markets. Investing in meme stocks, bankrupt companies, cryptocurrencies while depicting herd behavior indicates extreme (to an extent) irrationality and subjectivity.

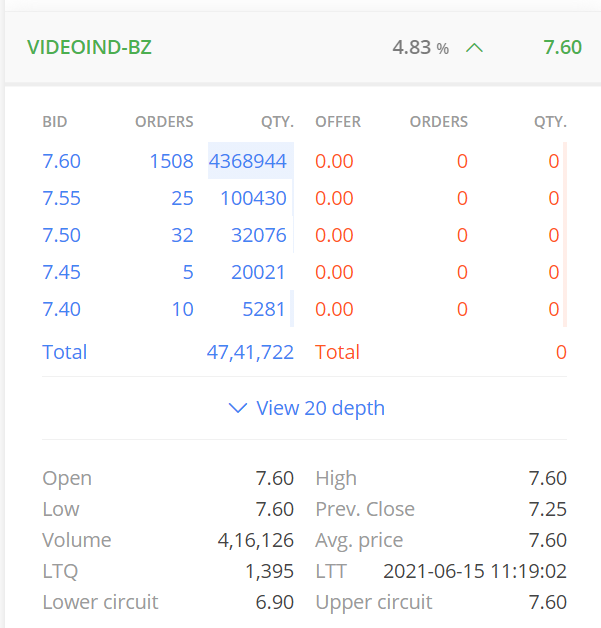

The above picture is the share price of Videocon, the day after the resolution plan was out to the public. The stock was hitting upper circuit when it was known outright that all the capital would be written off. This is the irrationality of the rational investors, probably the greed of earning quick bucks. The same instance happened with DHFL stock.

The so-called Efficient Market Hypothesis

In an ideal world, every investor has all the information, and stock prices reflect all the available information. This is nothing but Efficient Market Hypothesis. The theory is far from accurate, especially in the shorter time frame. Emotions like greed and fear drive the markets to an extent. The problem arises when these emotions get hold of the market players, leading to extreme movements in the market ( stock prices moving way past the fundamentals )

Increased prevalence of fin-twit and fin-grams (probably not a word) accounts

There has been an increased number of tweets and reels posted on various social media platforms in the past year. Some are good, while other just post stock tips or stock returns. X stock rose 100% or 200% in a short period. If you had invested in a Y (most of the time, it was an Adani stock or Tesla ) stock, you could have earned X amt. This is a classic case of hindsight bias, which is quite prevalent in the current market behavior. Prolonged rising markets also tend to accompany overconfidence bias, hiding our mistakes (bad picks) while providing a false sense of accomplishment.

Increased Retail Participation

Retail Investors currently dominate the Indian markets, which now constitute 45% of the overall trading turnover on the stock exchange. On the other hand, the retail ownership of the stocks has reduced from 18% in 2001 to 9% in 2021. This indicates the retail investors are instead trading in the markets than investing and holding the company. The increased participation seems counterintuitive when you think about the Covid situation. On one side, there have been partial lockdowns, decrease in income and savings, while on the other side, retail (in this context small players and not HNIs) have started trading in rather a volatile asset class. Is this going to last? Even I don’t know. The answer to this question will probably be known once there is a correction ( possibly > 10% ) in the market.

Is it time to be cautious?

I am no expert in the market. I am just trying to read and grasp the current environment and pen down my thoughts. There are many ways to judge whether a market is overvalued or undervalued, but one cannot follow them blindly. The high NIFTY P/E ratio is partly because of a couple of bad quarters of earnings due to Covid. This might create an optical sense of overvaluation when there is not. I just try to find a good business trading at a reasonable valuation and monitor them consistently.

I am not denying the fact that business has bounced back wonderfully after the initial lockdown. The markets have a tendency to extrapolate a good/bad performance leading to creating pockets of undervaluation and overvaluation. I would remain cautious and stay away from the areas of overvaluation. Indian businesses have shown resilience in the past year and I remain bullish on the Indian growth story over a longer time frame.

Subscribe to our Newsletter to get exciting content delivered to your Mailbox!

I would say, it’s a clear thought process. Keep sharpening your understanding & understand what way of investing suits you well. This will help you stay in the lead when the market will face drawdowns and generate alpha.