Introduction

While most of the population knows customer faced banking, banking has a whole different world in its backstage and regulatory reporting; supervising its branches is a substantial part of this backstage. Why are they so important, one may ask. The answer hides right under our noses; it is the size of our banks, the amount of financial fraud, and the ever-increasing regulations and fines imposed on the banks.

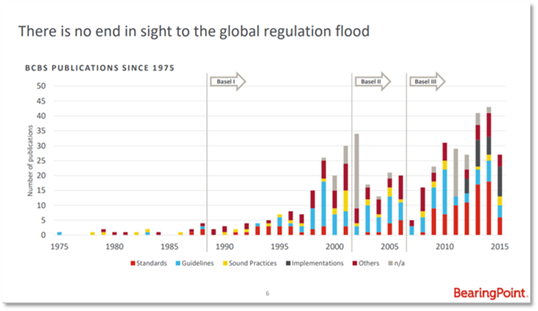

Firstly, Indian banks are enormous, our largest bank (SBI) has over 30,000 branches, and on average, a bank has around 3,800 branches in India, excluding the outlier SBI. Such size of the banks, operating manually in regulatory reporting, gives a window for errors, thus welcoming fines from RBI in huge numbers and amounts. Secondly, financial fraud has totaled 4.92 Lakh crores with more than 3 lakh crores in the last two years; this is a repercussion of weak systems in place to regulate such large volumes of loans, transactions facilitated by banks. Thirdly, since the 2008 financial crisis, there was a flood of regulations, and the ever-increasing volume of regulations doesn’t seem to stop.

The future of banking depends upon how well banks are going to tackle these three problems.

RegTech redefining the future of banking

Need is the mother of all innovations. Rightly said. The need to tackle the above problems has led to the innovation of new types of technologies. RegTech; A subset of FinTech. For the uninitiated, FinTech, a buzzword for almost a decade in wall street, refers to the penetration of technology and innovation in the financial world. In recent times, a niche type of FinTech has started gaining traction with a promise to change the financial landscape, called RegTech. RegTech stands for Regulatory Technologies, whose subset is SupTech (supervisory technologies). It refers to any technology that helps Financial Service Providers (FSPs) meet their regulatory requirements, stay compliant and have prudential supervision over their sub-ordinate bodies.

How Central Banks are leveraging RegTech?

Indian banks, especially RBI, are leveraging RegTech by partnering with FinTech companies to redefine the future of supervision and regulatory reporting in banks. The first and foremost problem RBI has decided to tackle is the reporting that banks have to send to RBI, IRDAI, and other regulators. Even a small bank with around 1800 branches in India has to submit over 200 reports each year. This process is filled with errors, manual brushing of data, and evergreening of books, basically trying to make themselves look good.

RBI has created a system of automatic data flow (ADL) to counteract this, and recently in partnership with TCS, has created a Central Information and Management System (CIMS) that takes microdata along with the required data entries, thus making it difficult to cheat the system, and this microdata can be analyzed in order to bring out patterns hidden to the naked eye. This has the potential to turn the tides of banks pestered with high-profile scams, NPAs, and Money laundering.

RegTech to make regulatory reporting a lot easier!

While the CIMS system has the potential to expose known and unknown patterns in money laundering, financial fraud, it also has the potential to make regulatory reporting a lot easier. Though the initial investment is going to be high, the benefits it offers are huge. RegTech, similar to CIMS, automates the manual process reducing the expensive human capital required for the report making, it is estimated that 10% of human resources are tied up in being compliant. Thus, automation reduces the cost, freeing up capital for the banks, on top of this, it also helps in keeping track of the ever-increasing regulations in reporting, also the frequent changes in existing laws.

The average time it takes to uncover a fraud over 100 cr is ~60 months

RBI

RegTech holds a promise of a bright future in banking, a day where it doesn’t take years to uncover the scams; yes, RBI annual report says that the average time it takes to uncover a fraud over 100 cr is ~60 months or five years. RegTech has enabled banks in analyzing data in real-time, a real-time risk profile of banks, branches, and customers, an alert system that shines light upon bank branches or institutions that are in troubled waters. RBI has already created an Early Warning System for the banks, but weak implementation led to not so significant drop in financial fraud, but RegTech will spell doom to such retrogressive practices of non-implementation.

India is not too behind!

Advanced countries aren’t so far ahead of India, but they’ve already implemented RegTech systems in their central banks. Bank of Italy has a system that analyzes any transaction over 10,000 Euro in its bank’s network; such analyses led to uncovering of known money laundering patterns. Banco De Spain has a tool implemented to detect the cases of misselling to customers, something that the infamous bank Wells Fargo was found guilty of committing. India’s neighbor China’s Central Bank, People’s Bank of China, uses FinTech enabled by BigData, AI/ML to analyze payment transactions, which allows them to get a better knowledge of the flow of money, sectoral behavior, early warning signals, and prudential supervision.

With digitalization accelerated by the pandemic, Indian banking will undoubtedly advance. But the burden is on the emerging RegTech and other FinTech partnerships to refine this advancement and curtail potential financial fraud that can cause thousands of crores loss to crores of Indian Taxpayers.

Subscribe to our Newsletter to get exciting content delivered to your Mailbox!