“They aren’t always character flaws. People with the best intentions and ethics fall for their temptation.”

Morgan Housel

Greed and Fear is something that is not only applied in the field of investments but also in businesses, industries, and countries. It is something that can either make or break one’s career. There is no amount of growth that can’t be destroyed by an investor’s temptation to grab too much of it. And there is no opportunity so appealing that it will catch the eye of someone who refuses to look.

It is quite astonishing to know that greed and fear are typically seen as opposites but share the same origin.

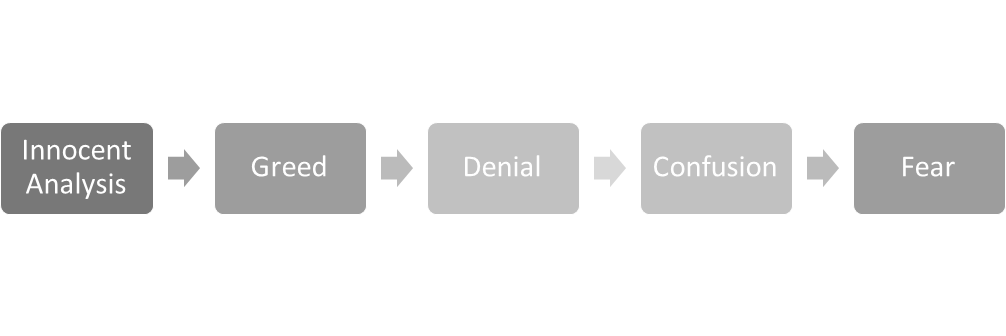

Let’s begin with how greed is evolved from an innocent idea:

You deserve to be right.

It’s really hard to wake up in the morning and look in a mirror without telling yourself that you can make good decisions. You deserve to be right because you have put so many efforts into developing your views and making decisions. You went to school, passed tough tests, did hard thinking and put in long hours. And hard work should be rewarded for being right. Effort equals reward, that’s how the world works, Isn’t it?

To be honest it becomes really tough for an individual to escape this thinking. One cannot admit that he does not know how the world works. No one is ready to start everything from the scratch because one has put in hard work and ample amount of time to believe that. So, no one does that. And here is where things start becoming problematic.

When one is being rewarded for being right, that too above average reward, a door opens in his/her mind that invites delusion to come inside. He/she starts building cause and effect relationship over here thinking, what did he/she do which has led to this amazing outcome. Whereas he/she doesn’t know that there can be a million other reasons for that thing to happen. From this situation, even others are going to get influenced too because they watched him/her getting that reward. Everyone likes praise, admiration, and attention. This particular act would trigger his/her mind and make him/her want more. The common form of innocent greed just starts extrapolating with enthusiasm that worked in the past.

Greed happens when you overestimate…

Greed happens when you overestimate how influential your past actions were on outcomes, enticing you to keep pushing right up to, and beyond, the point of eventual regret. For example, Mr. X earned money using ABC strategy earlier, now he feels that this strategy is the best way to earn money. Mr. Y told him that he was lucky that ABC strategy worked and warned him not to use it again. Mr. X felt that Mr. Y is stupid (he is in a state of denial) and takes double the leverage and bets on the strategy to work. He overestimated his ability to do things that will directly lead to rewards. Little did he know that the seed of fear is planted.

In his overestimation he kept on missing the sign which the world was trying to give him, he thought he should put more efforts at the strategy, once he is proven correct again bigger rewards will eventually come. He thought he was being patient, but actually, he was being stubborn.

Beginner’s Mind

Buddhism has a concept called Beginner’s Mind, which is an active openness to trying new things and studying new ideas, unburdened by past preconceptions like a beginner would. Assuming that one has a skill, can be the enemy to beginner’s mind, because past success reduces the incentive to explore other ideas, especially when those ideas conflict with one’s proven strategy. It’s dangerous. Being locked into a single view is fatal in an economy where reversion to the mean and competition constantly dismantles older strategies.

After Multiple failures, Mr. X begins to view himself as a victim. He was not ready to accept that he was never as much skilled. He keeps on blaming others like media is unfairly covering the company, Politicians are holding back the economy, etc. He was doing everything except looking in the mirror and understanding that he was wrong.

Then comes a point where it becomes obvious that Mr. X was wrong.

This thing can happen to anyone, one can lose the ability to look at the problem with a cool, rational mind becomes hazy when one is at the peak of greed. Now to hide from embarrassment one’s mindset shifts from growth to damage control, and fear what else can go wrong. Pain due to fear is ten times the joy out of greed. After some time, there will be a point in life when one starts to stabilize and accept the mistake that he/she has done in the past. The lesson was learned and he/she would avoid the same in the future.

Mr. X starts working on a new strategy, but this time he is more experienced than earlier. He feels that he was wrong before and this time he is right.

And being right means that one should be rewarded for being right. Effort equals reward. That’s how the world works, isn’t it?

It’s hard to wake up in the morning and look in the mirror without telling that one can make good decisions.

Isn’t that an innocent view?

That one deserves to be right?

And now we are right back to where we started

Learning:

Be open to new ideas, don’t be stubborn that the strategies will work now also. If your strategy has some flaws, work on it and improve it.

“It’s not the strongest species that survives, nor the most intelligent that survives. It is the one that is most adaptable to change”

Charles Darwin

All the credits go to Mr. Morgan Housel, who has written about this topic and shared his philosophy for the same.

Subscribe to our Newsletters to get exciting content delivered to your Mailbox!

Very well written Chirag. I have been following Morgan Housel for a while now, and this article simplifies the complex “psychological processes” that go into investing.

Will you be writing more on Psychology? (Finance and Non-finance)

Hello ruchika,

First of all thank you for reading it to very end, such articles can be a drag 😅.

Probably I would right something related to finance for sure.