Before Money was introduced into human culture, the only way to trade goods was through bartering. Barter system relies on the principle of coincidence of wants; you hope that you will find someone that you need and who wants something that you have at the same place and at the same time. Many goods used were perishable in nature and so can’t be stored for a long period of time; determination of the value of good against the other good was also a problem. To overcome all those problems and to make the exchange of goods and services uncomplicated, Money was invented. Money is something that is a medium of exchange, a unit of account, portable, Durable, Divisible, Fungible, and most importantly, a store of value. Cowry Shells, Cocoa beans, pieces of metals like gold, silver were used as Money, but they all had some or the other problems with them. Then came the use of gold and silver coins, which had all the characteristics of Money.

Classical Gold Standard

Gold has served as international currency since the 6th century BC, reign of King Croesus of Lydia to the major part of 16th century. England adopted the classical gold standard in the year 1717. Later part of the 19th century saw a flood of countries adopting the gold standard; Germany and Japan in 1871, France and Spain in 1876, Austria in 1879, Argentina in 1881, Russia in 1898, and India in 1898. While the US was using one troy ounce gold coins each worth twenty dollars each, it didn’t legally adopt the gold standard for the conversion of paper money until the gold standard act of 1900, making the US the last major nations joining the classical gold standard.

Under Classical Gold Standard, Paper Money, backed by Gold was used in addition to gold coins in circulation. The confidence arose from the gold that the paper was backed; otherwise, what value the piece of paper had. A person having paper money can easily go to the bank and get back the equivalent amount of gold. So the supply of Money was dependent on the supply of gold.

From 1870-1914 international trade grew rapidly, the world economy had an impressive growth track record with no almost no inflation, in fact, benign inflation due to technological progress that increased productivity and raised standard of living. The classical gold standard was simple and self equilibrating in nature, and when two currencies get anchored to the standard weight of gold, they get anchored to one another. There was currency stability, price stability during this period of time.

James Rickards, in his book Currency Wars, explains how prices remain stable during classical gold standard. A nation with improving terms of trades—an increasing ratio of export prices versus import prices—would begin to run a trade surplus. This surplus in one country would be mirrored by deficits in others whose terms of trade were not as favorable. The deficit nation would settle with the surplus nation in gold. This caused money supply in the deficit nation to shrink and money supply in the surplus nation to expand. The surplus nation with the expanding money supply experienced inflation. In contrast, the deficit nation with the decreasing money supply experienced deflation. This inflation and deflation in the trading partners would soon reverse the initial terms of trade. Exports from the original surplus nation would begin to get more expensive. In contrast, exports from the original deficit nation would begin to get less expensive.

THE WORLD WAR!

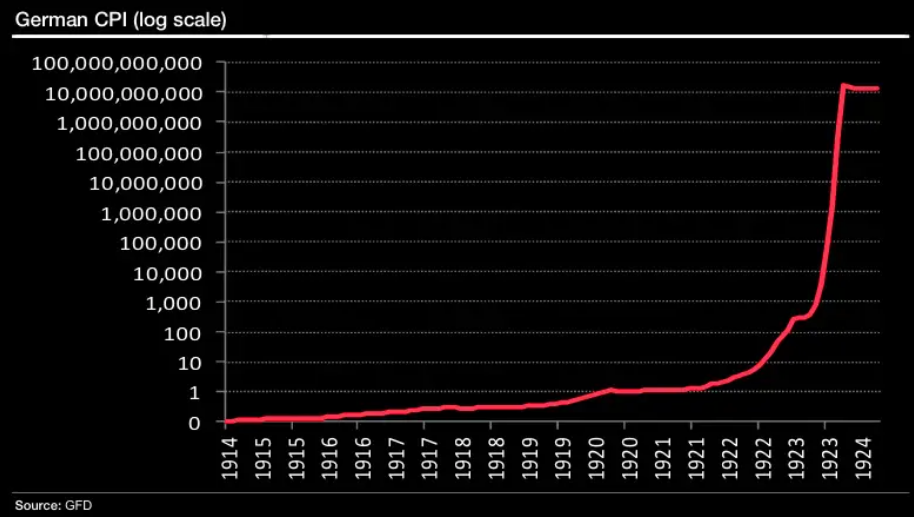

The period of 1870-1914 was the period of prosperity until the First World War, which lasted from 1914 to 1918, took major economies like Germany downhill. Germany had to pay France, Britain and its allies reparations amounting in billions of dollars, which it was in no condition to pay. Under the treaty of Versailles, Germany was given moratorium, and reparations could be paid in the form of goods like grains, coal, iron, lumber. German government started debasing the currency in an effort to restart the economy and boost its exports. This led to the continuous printing of paper currency without anything backing it.

Inflation began to take off in later stages of 1921 and turned into hyperinflation in the year 1922, the Reichsbank gave up control of the situation and printed Money in a frenzied manner. By 1923 the depreciation of the currency was in trillions.

After the collapse of the mark, a new currency was introduced in the country called Rentermark, which was then equal to a trillion marks. By 1924 the old hyperinflated marks were swept into dustbins, drains, and sewers.

Restoring Prosperity

After introducing a new currency, the Weimar government started restoring its foreign relations and renegotiating its reparations figures. The US-led Dawes Plan was finalized in April 1924, which included a more realistic payment schedule on reparations, and loans equivalent to 800 million marks were granted by the US. From 1924 immediately after the hyperinflation, German industrial capacity grew rapidly than any other major economies owing to the Dawes plan. After the world war, many countries suspended the gold standard.

Introduction of “Gold Exchange Standard”

Post the world war and creation of the new central bank, the Federal Reserve system in the United States in 1913; a new form of a monetary system was introduced known as “Gold Exchange Standard.” It was a modified version of the classical gold standard. It was modified so that central banks around the world had more control over the money supply and monetary policies.

More about how classical gold exchange standard and how the gold standard came to an end will be discussed in the next part.

Update : Click here to read “The Origins of Currency – Part 2”

Subscribe to our Newsletter to get exciting content delivered to your Mailbox!

Very well written Gaurav

When are you planning to publish the second part?

Thank you Amit Singh.

I will upload the second part within a couple of days

Immensely described. Looking forward for more articles.

Thanks Akshay, We will try continue bringing amazing content to you.