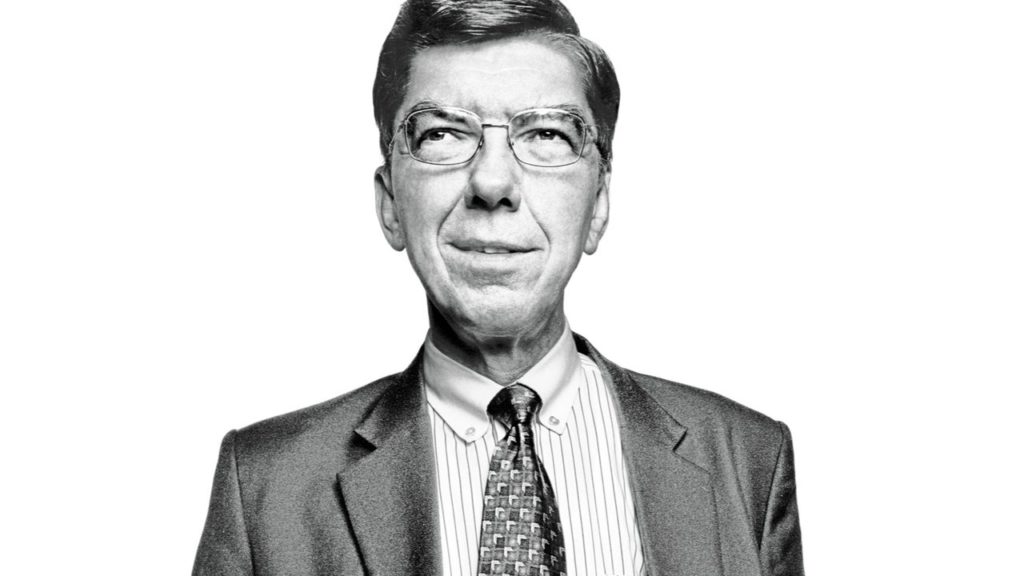

This article is inspired from a June 2014 Harvard Business Review publication, “The Capitalist’s Dilemma”, by Clayton M. Christensen and Derek van Bever.

Clayton Magleby Christensen was an American academic and business consultant who developed the theory of “disruptive innovation”, which has been called the most influential business idea of the early 21st century.

Most B-school folks have known Clayton Christensen for his theory of “Disruptive Innovation”. However, in this article, I will focus on a lesser talked theory of him; it doesn’t have a formal name, but it focuses on the negative impact of financial ratios on innovation. Clayton originally presented the idea at the 2011 Gartner Symposium. For those who don’t know, Gartner Symposium is an annual conference which addresses the strategic needs of enterprise CIO’s and their leadership teams.

What is the idea behind this theory?

The idea of the theory is that innovation is slowing down due to an over-zealous focus on financial ratios by “Financial Analysts”. This is true because financial markets have a tremendous influence on the “real” economy. It is further aggravated by the rise of B-school graduates turned managers who have been fed the chronicles of CAPM, DDM, EMH, and ours truly, the Black-Scholes Model right from the start of their career. What they try to do is, they fit innovation ideas into an excel software and fancy call it “Capital Allocation Framework Model” and work backwards in making decisions from there.

These so-called “Financial Ratios” were popularised by Wall Street in the 1980s to compare stock of different companies. But, this developed a new class of managers who made these ratios as a standard to formalise decision making around new projects.

Hyper-focusing on ratios like ROA, ROIC, ROCE, and IRR can cause even brilliant people to make wrong decisions. They do work as long as we talk about “Sustaining an innovation”, e.g., innovation like new Software to optimise Workflow, new Supply-Chain process etc.

But, there is a separate class of innovations that are severely underrepresented by these ratios.

They are called “market-creating” or “Transformative innovations.” Things like the first Virtual Reality, first Airplane, first Microchip, first Air-Conditioner falls under this class. These innovations can’t be evaluated on those “flawed” financial ratios; these innovations are very different as they enable a series of other innovation via network effects and thus unlock significant unexpected economic value.

Network Effects

Network effect plays a vital role in bringing innovations. To put out a vague example, a few days ago, I was watching this movie, “The Old Guard” in which it was revealed in the climax that each time when the lead saved a family from war, the descendants of that family(s) saved even more families, and eventually this went on; This saved a lot of humankind. Although it was a fiction, it very well explained the benefits of network effects.

Imagine if the first computer were never invented just because of low/negative Return on Investment, we would never have seen the Silicon Valley, the mammoth IT Industry, and you won’t be reading this article. On Finnick. On your Smartphone!

Why don’t these innovations fit under the orthodox Financial Ratio’s/Cash Flow model?

The timeline for such innovations is relatively uncertain and can sometimes be on the order of decades. As such, they require significant investments of capital without any return in the short-run.

The below Graphic Summarizes the Idea :

As a result, these innovations appear as relatively poor choices under an orthodox IRR/NPV/Cash Flow type analysis. Between choosing to invest in Driverless Car and a new, more improved CRM Software, our beloved IRR analysis will always declare the latter as the winner. But we clearly know that the former is much more valuable.

Due to excess reliability on Spreadsheets, firms today are under-investing in disruptive innovations. Jokingly, If Excel was invented before Microsoft, we might not see Microsoft today; because the Excel software returned a low NPV for Microsoft. Heh!

Case: How the hyper-focus on Financial Ratios affected the US Laptop Industry?

In the early 2000s, major US Laptop manufacturers like HP and Dell chose to outsource manufacturing to China. The Spreadsheets “dictated” that it would be capital efficient to outsource some of the processes of the manufacturing chain to Cheap, low-cost Chinese players (Lenovo). Now because of this, initially their net assets went down, and ROA and ROE went up as the standard theory would suggest.

Wall Street initially welcomed the move, and the stock rose.

Little did they know it helped China achieving the scale. They went away from being a mere assembly player, and forward integrated into design and distribution. They mastered the art of in-house design and set up their own distribution agreements. As a result, Lenovo, a mere one-time outsourcee became the largest laptop manufacturer in the world.

Conclusion

The crux of the discussion is that investments in different types of innovation affect economies and companies in very different ways- but are evaluated using the same (flawed) metrics. Reliance on those metrics is based on the outdated assumption that capital is a “scarce resource” that should be conserved at all costs (It is still a guaranteed question for three marks in an 11th-grade Business Studies question paper). But, as we all know, it is no longer scarce!

‘It turns out God has never created data; every piece of data was created by a person. It isn’t real. It’s a representation of phenomena… but there’s a lot about the context in which customers live their lives that don’t get incorporated into data of the type most of us imagine.’

Clayton Christensen

Subscribe to our Newsletter to get exciting content delivered to your Mailbox!

This is really a commendable article, Nikhil.

It’s unfortunate that funding decisions are largely governed by the ‘numbers’ of an entity/start-up. (Inspite of our 11th std Accounts Theory Question for 4 marks – Disadvantages of Financial Ratios – Fail to incorporate qualitative aspects..Lol!)

Even though metrics such as ‘Price-to-Innovation Adjusted Earnings’ have been theoretically introduced, yet the practice and focus tends to remain on traditional ratios. Maybe Old isn’t always Gold.

Anyway, wonderfully penned down article! Looking forward to more!

Thanks Shourya! I think 11th std has a lot more to teach to us haha. Yes, old isn’t always gold.

Remembering exact lines from class 11th.. Thats commendable. I can’t even recall direct taxes provision I read last year

Haha. Maybe having those 3 soaked almonds every morning worked well for me. 😜

I too should have taken that seriously 😔

That’s really some out of the box thinking. Very well written.

Thanks Rahul

You never fail to deliver quality and well researched content. I always feel that professional management is a very big reason for lack of innovation. Outside CEOs, in order to have huge bonuses and maintain their image, just focus on numbers and ignore long term vision of the company. The reason many companies fail after founders aren’t in management anymore

Thanks Dheeraj. Yes, founders always play a very important role for long term growth of an organisation. When Amazon launched Fire Phone, it miserably failed, yet, Jeff decided to continue with the Fire team. The Fire team started to work on Alexa after the Fire Phone. Today, we all know how deep is the Alexa ecosystem. I doubt if there were someone else, he would have probably shut the Fire lineup!