Alembic Pharma is a vertically integrated pharma company and undertakes to manufacture branded formulation, international generics and Active pharmaceutical Ingredients with globally benchmarked facilities. Company is engaged in diverse therapeutic segments which include Ophthalmology, Dermatology, Antidiabetic, Gynecology and Oncology.

Manufacturing Facilities

Alembic Pharma has six formulation Plants and three API Plants, of which F2, F3 and F4 and one of the API facilities have been created in the past two years, with the focus of increasing the foothold in the international markets and introducing complex formulations.

Business Segments

International Generics

- Alembic Pharmaceuticals generates more than 50% of its revenue from the international market, of which the US alone accounts for more than 40% of the total revenue. Company has filed 191 ANDAs, with 125 Approvals and 79 products launched so far in the US markets. Company has set up its front end team in the US to cater to its diverse portfolio in the US markets. Out of 79 products launched so far, 72 products are launched through the US front end, and the rest 7 are on partner labels.

- At the time while many companies were struggling with their US operations, Alembic has doubled its Cumulative ANDA filing in the last three years, and product launches have increased simultaneously. This has been quite visible from the company’s increasing share of US generics revenue in the past three years. Few of the critical launches include Abilify, Sartans, theophylline, Azithromycin, Febuxostat. The top 5 products in the US accounts for 35% of the Company’s US generic sales.

- The company had only one plant located in panelav Gujarat, which was used to cater to international generics demand, recently the company has completed its 2000 Crore Capex towards increasing its formulation and API manufacturing capacities. Company has built four new facilities, increasing its OSD capacity, apart from oral solids company has created facilities for generic injectables and oncology injectables, which are likely to yield results in the coming years. Out of the four plants, only one of them has been commercialised.

- Management has given guidance for 25-30 ANDA filing for FY 21, and simultaneously 15-20 launches are expected. With injectables facility coming live, the company is likely to enter into complex generics as well.

Ex-US Generics

- Ex-US generics include revenue from majorly three geographical areas, Europe, Australia and Canada. Revenue from this segment has struggled quite a bit in the past few years showing degrowth in FY 18. Recently there has been a Serialization issue going on in Europe which, according to management, is completed and they will be in a better position to cater to the vendors. Q1 has shown some improvement in sales, and it is expected to continue the same momentum going forward.

Branded Formulations

- Branded Formulation includes revenue from the Indian branded generics market. The company has a presence in both generics and branded generics, while the quantum revenue is generated form branded formulations.

- Company has a presence in multiple therapies including cardiology, anti-diabetic, gynaecology, gastrology, dermatology, orthopaedic, ophthalmology, nephro / uro, anti-infective and cold & cough. Company has a 30% share in azithromycin.

- Company has a presence in both acute as well as chronic therapies. In the last three years, sales in domestic formulations have been sluggish. Management has recently taken certain strategic measures like Withdrawal of stockist promotions and inventory adjustments initiated towards the end of 2018-19 will help improve supply chain hygiene henceforth.

- Company’s 16.75% of the branded formulation portfolio is under the National List of Essential Medicines(NLEM), where the increase in price is dependent on WPI. Company has a marketing team of 5000+ personnel which caters to 175000 doctors across India. Per MR productivity has scope to improve.

Active Pharmaceutical Ingredients(API)

The company has 3 API facilities, two in panelav and one in karkhadi. Alembic is a fully vertically integrated pharma player, so about 80% of its API requirements ( to manufacture formulations), comes through internal capacity.

API revenue has grown at low double-digit from FY 17 to FY 19, and there is de-growth in FY 20, the revenue has not gone anywhere partially because the company’s major focus has been on formulations and most of its API is consumed internally. Quarter 1 of FY21 was quite good, which was aided by disruptions in China and the company being the largest manufacturer of Azithromycin had certain COVID led demand. The tailwinds in the API segment are likely to continue, which would aid the company to grow its API division. Management has guided 15-20% growth in the API segment for FY21 and hinted for the capacity expansion too.

Major JV and other Deals

Aleor Dermaceuticals Joint Venture.

- In 2016 Company formed a 60:40 JV with Orbicular Pharmaceuticals Technologies Pvt Ltd for developing dermatology products for international markets. Company has set up a greenfield manufacturing facility for dermatology products in Karkhadi, which is USFDA approved and is currently operational. The JV has filed 21 ANDAs and received approvals for 7 Approvals as of FY 20. The JV has a Strong planned pipeline of products.

Rhizen Pharmaceuticals

- Rhizen is a clinical-stage biopharmaceutical company focused on discovery and development of innovative, small molecule drugs that target signal transduction networks and ion channels for the treatment of cancer, inflammation, autoimmune diseases and metabolic disorders. Alembic owns 50% of the Company. Rhizen had entered into an out-licensing agreement for TGR-1202 (Umbralisib) with TG Therapeutics in September 2014.

- On August 12, 2020, the Company received notification from the FDA of its acceptance of the Company’s NDA for Umbralisib as a treatment for patients with previously treated Marginal Zone Lymphoma (MZL) and Follicular Lymphoma (FL). Rhizen Pharmaceuticals is eligible to receive milestone payments for filing, approval and launch of the product and then sales-based royalties.

Financial Performance Overview

- The company had a consistent sales and profit growth from FY11 to FY16, as it is entering the US Markets, and growing its presence in the domestic markets as well. In FY16 Company launched Abilify, a blockbuster drug which generated a considerable amount of revenue and more than doubled the profits. As this was a one-off opportunity for the company, the growth normalised in further years.

- From FY16 to FY 20 with increasing US FDA regulations and increasing competition affected the whole pharma industry. On top of it, demonetisation and implementation of GST also had an effect on the company.

- Through the past three years, the company has considerably grown its International generics revenue, especially revenue from the US, but it has lagged in domestic formulations as well as API. With tailwinds in the API industry and certain measures to improve domestic business are taken, both segments are expected to perform well going forward.

- As the new facility starts generating revenue, pre-operative expenses would flow through P&L statements weighing on the margins for the short term, but as the sales grow operating leverage would kick in.

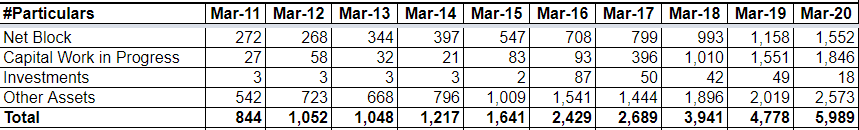

Capex Plans

- Alembic had undertaken a major capex amounting to 2000 Crores. The primary focus of the capex was to increase the foothold in the international generics market, particularly the US markets.

- Company has added four new facilities, two of the facilities are dedicated for Oncology, one is for oncology oral solid and other for oncology injectables, and the other two facilities are for general injectables and general oral solids. These Capacities are likely to be commercialised by the end of FY 21.

R&D Capabilities

- Alembic has 3 R&D facilities, one in Vadodara, another in Hyderabad and the last one in New Jersey USA. The Company has a team of 1200+ personnel across three development centres.

- Indian generic pharma companies have R&D Expense as % of sales in the vicinity of 7-10%, but for alembic, it has been on the higher side, going as high as 14% in FY20 and R&D is almost 100% of the net profits. Even though such a high expense can be a cause for concern, management has justified it with increasing launches and doubling ANDA filings in the past three years. Research and development are of long term benefit in nature, and if used efficiently, would lead to value creation. Despite having such high expenses, the margins have remained relatively stable and even increased in FY 20. Management has guided that in absolute terms, R&D Expense is likely to stay in the range of 650-700 Crores.

Company’ Debt Profile

- The recent capex was funded by debt and internal accruals both, and this led to an increase in debt-equity ratio from 0 to 0.5. The interest coverage ratio has also fallen but looks healthy at 38 times. Company in the Q1FY21 concall mentioned that the company is likely to raise funds through QIP, which would be used to pay off debt as well as for more capital expenditure.

Management

- Amin Family runs the Alembic Pharmaceuticals, headed by Mr Chirayu Amin, who is the Chairman and the CEO of the Company. Mr Pranav Amin and Mr Shaunik Amin are both the Managing Director of the Company.

- Management seems to be enterprising, trying to tap various growth opportunities in the international markets, being spent a huge amount of money in research and development and capacity expansion. The increasing number of ANDA filings and launches in addition to entering into oncology therapy and complex generics seems like it might pay-off in the coming quarters.

Valuation Perspective

- Alembic Pharmaceuticals is currently trading at a P/E ratio of 19 with ROE of 25% and ROCE of 20% and an average earnings growth rate of 24% over the past five years. With capex commercialised, the company would enter injectables and oncology as a new therapeutic segment as well as increasing their oral dosage capacity. The measures taken to revive the domestic business would hopefully add to its international generics growth. I expect the earnings to grow at 18-20% over the next four years.

Disclosure: Views might be biased as I am currently invested in the company

Subscribe to our Newsletter to get exciting content delivered to your Mailbox!