So Folks, this post is after seeing the noise on the street regarding market crash, I thought I will put forward how I see markets going forward.

I don’t time the markets and this mail is just a reflection of what is going on in my mind.

Human behavior cannot be predicted. Distrust anyone who claims to know the future, however dimly. I have come across many people across all levels of Nifty be It 8000, 9000, 10,000 predicting markets are overheated and are ready for a crash.

Why do we go on listening to economic forecasters when they plainly know no more about the future than you or I? We listen, no doubt, because knowledge of the future is and has always been one of the most desperately sought human goals.

There are things that can be predicted. We know precisely when the sun is going to come up each morning, for instance.

The reason why such things can be predicted is because they are physical events. But when it comes to the world of money, it is determined by combined actions of human behavior.

To give one example, people on the street were so pessimistic that very few saw a real estate recovery, though gradually but yes, it is seeing signs of rising from slumber. No one had a clue about the thought process of the prospective buyer.

The stock market, for example, is a colossal engine of human emotion. Prices of stocks rise and fall because of what men and women are doing, thinking, and feeling.

Human behavior plays a very important role as to what happens to markets in the short to medium term. Currently, Markets have bounced back, Economy is yet to catch up. So probably, if you believe markets are overheated, the economy is YET to catch up.

I don’t have the capabilities to chart the economy, all I can say is we have ample liquidity floating around to support the recovery. Liquidity cannot be sucked out in a jiffy since past recessions have shown, liquidity when sucked out immediately, it comes at the cost of growth. We will have sufficient liquidity to support growth till the time, growth doesn’t need the liquidity ventilator (this is the ideal way to suck liquidity, or else we will have another Taper tantrum crisis).

I rather focus on the companies I am invested in, betting on companies whose demand tends to remain intact whatever the economic scenario looks like, and hence earnings growth will support the share price growth.

Just to put things in perspective, We did have a bear market from 2017 to mid-2020, where the midcaps and the small caps didn’t perform (except the quality ones who had their earnings growth intact). We have to go beyond Nifty50 to get a sense of where markets are reflecting the economic slowdown.

Now coming onto the behavioral aspect (my own thought process on behavior and reserve the right to be wrong):

o Crashes happen when the world is not expecting.

o Recency Bias: Where almost all the investors have seen a swift recovery, Nifty falling all the way to 7500 and then recovering 14500. I don’t recollect such swift recovery happening ever. This bias of markets falling and then recovering quickly will avoid markets going deep down since every buyer will have an incentive to chip in at every fall.

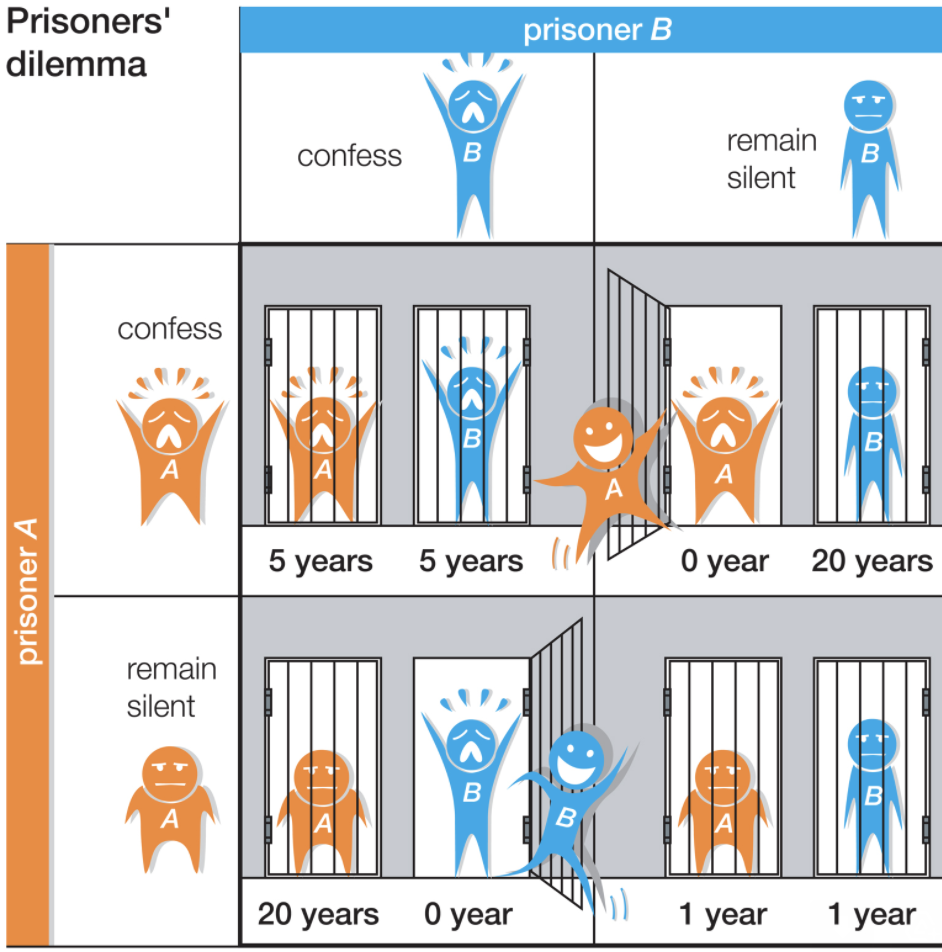

Lets discuss prisoner’s dilemma for the above point.

Two prisoners are caught in a robbery. Both are locked in a room and are isolated and urged to confess. Both are given the the outcomes as depicted in the table above.

Both prisoners, however, know the consequences of their decisions: (1) if both confess, both go to jail for five years; (2) if neither confesses, both go to jail for one year (for carrying concealed weapons); and (3) if one confesses about their indulgence in robbery while the other does not, the confessor goes free (and the silent one goes to jail for 20 years.

The ideal outcome is both remain silent and get 1 year of imprisonment each (both cooperate with each other).

However, they tend to think selfishly, wherein one is unsure about the other person remaining silent and cooperating and hence they both confess and end up being in jail for 5 years. Since if A remains silent and B confesses, A goes for 20 years vs 5 years and vice versa.

Correlating the above dilemma in the markets, when everyone awaits a correction, I as a person am unsure if the crowd will waiting for a decent 20-30% fall (the decent amount of fall to accumulate stocks) or starting buying on every dip, since I don’t want to be left out again, I will also support every dip with my buy orders rather than waiting for a 20-30% fall.

o Lastly, I believe optimism around spurs optimism. At the time when the world was in lockdown, people were worried about their jobs, no one had an incentive to make discretionary purchases since the future looked super uncertain. Now, when the auto numbers and real estate numbers look robust (plus interest rates are in favor), most of them who had held back have an incentive. Also, with interest on deposits abysmally low, all mathematical smartness of keeping money in FD and staying on rent goes down the drain. First home ownership when interest rates are low always supports real estate recovery.

Recently, spoke to the dealer of the largest automotive in the country and the sales guy of the listed premium developer, and both believed that the inquiries to sales conversion has improved drastically. This pandemic has ensured only serious buyers step out and make the deal.

To Conclude : A 10-12% correction is very healthy, however, I am bullish at least for the companies I am invested in.

Take it with a pinch of salt, since I am very small element in the market to predict someone else’s behavior.

Subscribe to our Newsletter to get exciting content delivered to your Mailbox!